I said, "Banks are Dumb as Rocks." because banks had no clue how to handle golf courses.

I watched several banks turn down excellent offers for golf courses in their special asset portfolios, then later (sometimes only a few months later) accept up to $1 million less. Meanwhile they paid management companies up to $12,000 a month to 'baby-sit' the golf course, whereby they (management companies) more or less let the place rot on the spot. I know, because I brokered a bank-owned golf couse for at least $1/2 million less than they could have received barely 6-months earlier.

This is a story about a guy who dealt with the bank in good faith. The banker urged him to maintain his good credit (pay on time). The result, in my opinion, was purely ruthless.

n

PLEASE READ MY DISCLAIMER FIRST: Articles on Golfmak.com web site are based entirely on my own experiences in the golf course business. In my career I saw or understood the outcome of various scenarios in all kinds of golf course operations in many US States and Canada. Facts, places, and names may have been changed or purposely omitted to protect confidentiality. An example outlined in this article occurred as I (personally) understood to be what happened between a golf course owner and his banker. However, some parts may be different from what I believed to have occurred. Be aware that your experience and results may be different. Any decision you make, whether influenced by this document or not, is your sole and absolute decision. Professional advice is recommended. I take absolutely no responsibility for your results. Michael A Kahn.

When the titanic sunk there were not enough lifeboats to save everyone – because they thought she’d never sink!

Banks thought they'd never sink. Therefore, they had no mechanism in place to handle their failed lending schemes (isn't loaning out the same $1 dollar 16 times a scheme?).

I've received calls from golf course owners all around the USA asking for advice, because their banker is calling in their mortgage.

Does this sound familiar?

You’ve been a good bank customer. You’ve proudly paid your mortgage payments on time every time – sometimes for many years

The loan officer at your bank is on a first name basis with you, often takes you to lunch, and keeps telling you how he/she appreciates you as a good and loyal bank customer

Your loan officer might even tell you the bank will renew your loan (‘for sure’) as long as you have a perfect payment history (in my opinion, the first lie)

Comes 2009, 2010, 2011 and the bank's own lending scheme starts to unravel.

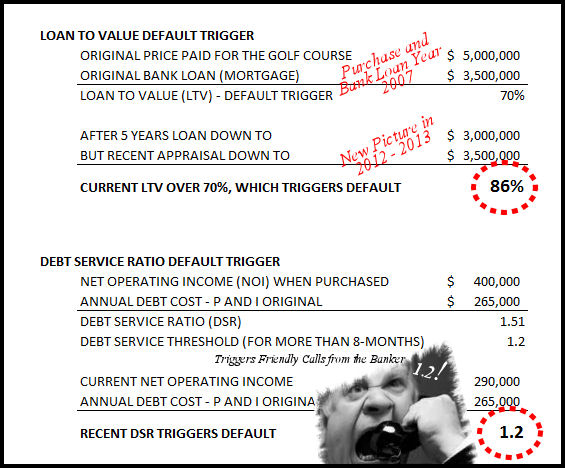

The first bad sign: The bank orders an updated appraisal and it turns out it shows a substantial drop in value. The result shows the loan-to-value (LTV) has fallen below their 60% ceiling, which triggers default.

Very likely your loan officer (likely on orders from head office) tells you not to be too concerned so you won't panic and abandon ship too soon (remember, they don't want to own the golf course). They want you to keep up your payments so not to draw further attention to your account from ‘upstairs’. Many bankers had the bank examiner on their case because their balance sheets fell out of whack after the appraisals came in too low.

SIDE BAR….Here’s what I believe you need to know as the debtor (golf course owner): In my experience I believe the bank is horrified that you’ll throw them the keys. I'll bet the following scenario is happening to you right now:

- You begin receiving ‘friendly’ threats from your loan officer

- Soon your first incoming phone call in the morning is from your local loan officer.

- Your friendly 'first-name-basis' loan officer will blame the bank's head office policy for the current dilemma but he/she seems to have your interests at heart (often really the truth).

- Your loan officer will try to be nice and helpful sounding, but will ask things like how much to you expect to take in the coming weekend, or will cash flow meet the next loan payment.

- They will put pressure on you to find alternate financing (which is absolutely not available in 2011-2012).

- Meanwhile, business is slower this year (as is golf in general around the USA in 2011) and you can feel yourself almost wishing dollar bills would sprout up out of the fairways.

Next you start the pre-payment membership drive to get cash to pay the mortgage. You start offering discounts and perks to wrestle a year’s worth of dues out of people.

But then comes the moment when you have to choose between paying the banker or the utility bill.

Now this is strictly my opinion based on my experience (subject to disclaimer): I strongly feel it is a mistake to pay the bank and have your electricity shut off, because it accelerates the implosion of your business. Remember, the bank is first creditor (behind government). The mortgage sits on top of all other loans, so the bank is protected - and they won't shut off your utilities if they don't get their monthly mortgage payment. The loan officers want your mortgage payment to keep his/her bosses of their backs.

The bank mortgage is second only to government liens. In my opinion and experience, subject to my disclaimer, I recommend keeping your suppliers and services paid ahead of the bank, because you need electricity, fertilizer and toilet paper. I believe you are better off paying your unsecured creditors before your mortgage payments (remember, that's ONLY my opinion). You need supplies and services to have any chance of surviving. I believe you can hold off the bank far longer than you can hold off a vendor who sells you supplies or services critical to keeping you in business.

Remember! In my experience I believe the bank is

horrified over winding up with the golf course.

The bank will play the fear game on you, call you every day and ask how many tee times you have booked. Meanwhile, you’re up to fourteen hours a day on the job and sleeping at night with one eye open. You’re cleaning your own restrooms, mowing your own fairways and fixing your own irrigation leaks. You come in the next morning and if life isn't tough enough, the first call in the morning will be from your banker. However, worse still, now it's your suppliers who are calling. You're getting close to the point when can’t get fungicide, gasoline or even toilet paper because your bank debt leaves you with no operating cash.

But the bank does not want to own your golf course! Keep remembering that.

Now I’m going to tell you a true story about a hard working golf course owner and his banker. I know this story because I helped this fellow buy his golf course and advised him (we’ll call him Brad) for several years:

His banker, a major US bank (I don’t wish to be sued), promised Brad they loved him as a client and would renew his note for another five years on balloon date (I told Brad to get that in writing, which they never gave him). His loan officer took him to lunch and encouraged him to continue to be a good bank customer and be on time with his mortgage payments, which Brad did reliably.

Keep in mind that when Brad bought the golf course he put over $1 million down and financed approximately $2.2 million based on a purchase price of $3.2 million, which was a decent deal at the time. His banker competed aggressively with other lenders to get the loan, because the subject golf course had a $4.5 million appraisal and a decent revenue history – they wanted that loan!

Fast-forward to 2009, the balloon date approaching. The borrower was perfect and had paid principal and interest and the loan balance was down to $1.8 million. Negotiations began and Brad began to panic a little, because the banker was stalling with his loan renewal. (Remember, it’s 2009 and the financial mess is well under way). Finally, Brad was informed his loan would not be renewed and he had to find another finance source. The bank gave him time to seek other sources. However, other than 'knee-cap' finance, there was no golf course loan money out there.

Knowing his bank was abandoning him, Brad began to seek private investors offering partnership shares and all sorts of perks to replace his banker’s loan. Brad even tried to bargain with the bank to buy the note at a discount with an investor’s money and the bank refused saying they wanted 100% of the loan paid – plus any penalties for late payments. It was the first moment the bank bared its teeth.

Now, some of you reading this will find this incident familiar:

Brad made an appointment with his loan officer. When he got there a complete stranger was sitting at his loan officer’s desk. The stranger was not friendly, in fact downright nasty. The stranger warned Brad that he was signed personally and the bank would go after his home, his car and would even go through his sock drawer if they had to.

Brad was the deer in the headlights.

Meanwhile, I found an investor in Canada who indicated he would offer to buy the note from the bank for cash and renew the terms with Brad, which would have dropped Brad's loan payments by close to $100,000 a year. When Brad approached the bank asking for a discount, the bank said they might consider a measly 10% discount from the principal. That meant his $1.8 loan could have been paid off for $1.62 million. But the bank had one major problem:

Before the balloon date on Brad’s mortgage the banker ordered a new appraisal. The shock was that the latest appraisal came in at only $1.6 million (it was $4.5 million just seven years ago). So, guess what? The bank was upside down, because their LTV ceiling was 60%, which meant the loan should be no more than $960,000 (principle was $1.8) Brad was upside down too, because he was signed personally and was $840,000 exposed.

At this point, after watching deals with other banks that were also upside down, I knew the bank would take a cash-out and might even release the original borrower from the personal guarantee.

The Canadian investor went directly to the banker (not the local loan officer), showed his cash and made a cash offer to buy the note, but only after an accommodation with Brad whereby the note would be re-written. It would have reduced Brad’s annual debt service costs by over $100,000 a year, yet make the investor more than a 10% return on his money. So, the banker indicated he would seriously consider accepting the cash offer. It was a good deal all around. The only other condition the Canadian demanded of the bank was the bank was not to not to ‘shop’ his offer.As I understood happened, the banker hung up the phone and immediately shopped the Canadian’s offer and accepted another offer from a party in New York. The new offer was from an investor who really wanted Brad’s golf course. The new party had already done his diligence - actually made a deal with Brad similar to the Canadian's deal - so Brad was unconcerned at that point. However, out of the blue, Brad is informed that the new note holder was foreclosing and was kicking Brad out, which he did.

There was a little more stuff that went on in this story, but the picture shown here make me wonder:

- Why would the bank take a 50% hit on their principal from a stranger, but would only offered Brad, a proven good and loyal customer of that bank, only a 10% discount?

- Why wouldn’t the bank renew the note with Brad at, say, $1 million – probably at a higher interest rate, which would have put the banks’ balance sheet in order and reduced Brad’s debt service? Didn't Brad prove to be a good bank customer?

- Where’s the honor when the bank promised Brad they would renew his note?

- Where was the honor when the bank shopped the offer from the Canadian?

It’s October, 2011 and Brad is out of the golf course business. He’s studying for his real estate license. The bank that competed to get his golf course loan business spit him out like a watermelon seed.

KNOW WHEN IT IS TIME TO THROW THE KEYS AT THE BANK!

What I’m saying here (strictly my opinion) is that golf course borrowers need to be more aggressive with their bankers in 2011 (now 2013). You need to watch for signals that indicate the bank is stringing you along. There is one critical sign that the bank is closing in on you: The loan officer is calling you often. So what can you do?

Do what the banker is doing: CYA!

Subject to my disclaimer, and based solely on my own experience, I believe when you see those signs from the banker you need to go on offense to protect yourself. You have to consider yourself and your family first. However, you need to be honest with the banker (even though they might lie to you), because the banks have all those lawyers in their camp.

However, being honest doesn’t mean you can’t do what you have to do to protect yourself and your family.

Being honest: I don't think you are obliged to tell the banker what you plan to do - at least without advice from your own legal counsel. Remember, in my experience the bank does not want the golf course! And they really don't give a damn about you!

LAWYER UP! You need to lawyer up yourself. Consider filing chapter-11. Meanwhile, you need to look for ways to move your assets where the bank cannot get at them (legally, of course). You need to build up as much personal (not business) operating cash as possible.

You have to be prepared to throw the keys at the banker (it might even be fun).

You have to be prepared to let it go. I mean to be ready to throw the keys to the banker. Don't keep trying to bail out the Titanic! You know when you are completely sunk, so jump ship while you can save yourself. I've watched course owners wring themselves out financially trying to save their golf course ownership. They left with barely the shirt on their backs. In my opinion (subject to disclaimer) you need to throw them the keys while you still have money left for your next life. You'll need it.

LAWYERING UP: Again, from my experience and subject to disclaimer: If your golf course business is in financial trouble and is in a smaller community subject to my disclaimer: Do not hire a local attorney. I believe you should hire one from as far away as possible so the local business familiarity doesn't’t interfere with your interests. Bankers, attorneys, and business people in small communities tend to lunch and party together, so everybody knows everybody’s business. An attorney from a distant neighborhood will be less likely to have ‘buddies’ in your area and won't owe anyone any favors. You especially can’t take a chance that the local attorney is too friendly with your banker.

If you recognize any of what I outlined in this article you are welcome to give me a call: 941.739.3990, or write: mike@golfmak.com - if for no other reason just to discuss it. At least you might feel better knowing you've got lots of company today. I charge no fee for a first time consultation - and I will NOT try to solicit you in any way.

Mike Kahn